Bombardier said this week it is reevaluating its participation in the Airbus A220 program and hinted it may sell off its business aviation division as well to pay down debt. The company cut its 2019 financial forecast for the second time and that prompted fears of its long term financial viability and a sell off by investors. The company lost almost a third of its share value in one day. Bombardier is a 31 percent partner with Airbus (50.1 percent) and the Quebec government in the A220, which was developed by Bombardier as the CSeries. But Airbus wants to ramp up production and Bombardier doesn’t have the money to pay its share of the expansion costs and the financial forecasts for the aircraft predict it will take longer for the program to break even and that it won’t make as much money over its lifetime as originally thought.

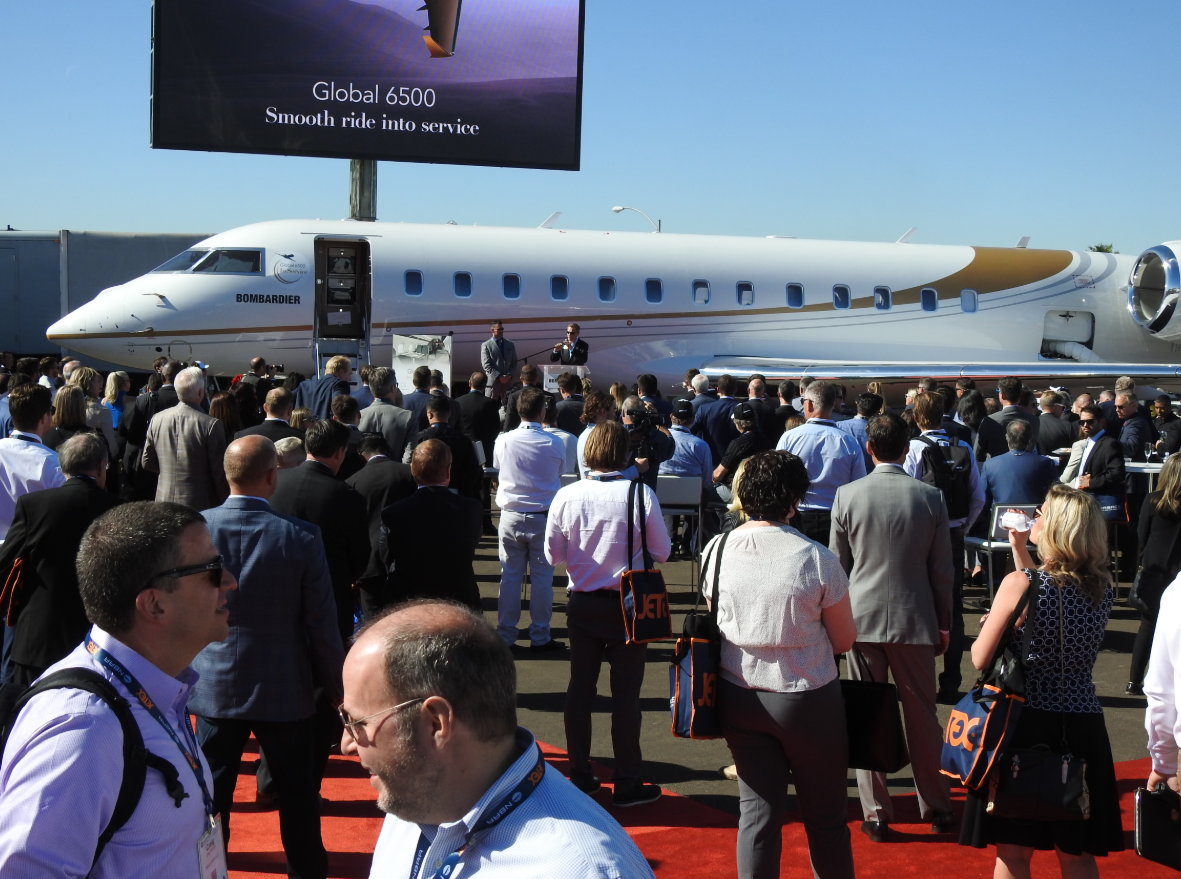

Bombardier sold off its water bomber and Q400 regional business to Viking Aircraft and its regional jet program to Mitsubishi, leaving only its high margin business jet business in the aviation division. Bombardier has been aggressively competing against Gulfstream for the lucrative large-cabin bizjet market and recently certified its latest long-range and ultra expensive aircraft and celebrated at a splashy event at the National Business Aviation Association convention in Las Vegas in late October. It also sold its facilities at the former air force base at Downsview where it builds the business jets. It has to be out of Downsview in the next few years and recently announced it will move production to a huge new facility at Pearson International Airport.